Company Spotlight::

Rocket Lab

CEO: Peter Beck

Year Founded: 2006

Headquarter: Long Beach, CA

Employee Count: ~500

Signature Products/Features:

Electron: Smallsat launch vehicle

Rutherford: Electric pump-fed engine

Photon: Smallsat satellite bus

Rocket Lab is not your usual rocket company. On one hand, it is a company that doesn’t really take itself too seriously - which other company can you think of names their launches “Still Testing,” “It’s Business Time,” and “This One’s For Pickering”? Its CEO and CTO Peter Beck, though not as outlandish and eccentric as Elon Musk of SpaceX, is a down-to-earth engineer who gives frequent interviews to Youtube personalities such as Everyday Astronaut, shedding light into design decisions that are normally kept closely under wrap. On the other hand, it is a company that has had 11 total orbital launches and has recently begun testing its first-stage recovery system, hoping to one day recover and reuse the entire first stage of its rocket, the Electron. All of this, combined with the fact that the company mainly launches out of New Zealand, where Beck first started the company, makes Rocket Lab an incredibly unique and interesting company to study.

Even though its quirky culture stands out amongst the monotonous culture of aerospace companies, Rocket Lab is backed by hard innovative technologies such as an electric pump-based engine and advanced engineering techniques that allows for both rapid assembly and drastically lowered costs. It is a winning combination that may allow the company to claim the emerging smallsat launch market amongst a very crowded competitive landscape.

Taking Aim at the Smallsat Launch Market

Rockets today can be roughly divided into four segments based on lift capabilities - small-lift, medium-lift, heavy-lift, and super heavy-lift vehicles. Rocket Lab falls within the first category, targeting customers wanting to launch payloads up to 225 kilograms into Low Earth Orbit (LEO). This contrasts with the more conventional medium-lift rockets from SpaceX and the United Launch Alliance, each with capabilities of launching over 20,000 kilograms of payload into LEO. The goal of Rocket Lab isn’t to go big, however, but to target the ballooning miniaturized satellite market, with payloads ranging from as low as 1 kg to up to 200 kg.

Traditionally, the launch industry has been focused on launching big, multi-billion dollar satellites, as most of the commercial satellites launched belonged to telecommunication companies. These satellites operate at a higher altitude - the geostationary orbit - and require significant payload capacity to get there. This is the segment that SpaceX has been excelling at with its Falcon 9 vehicle, costing around $60 million per launch.

Most smallsat operate in Low Earth Orbit (which sun-synchronous belongs to), whereas major telecommunication satellites operate in the much higher geostationary orbit.

SpaceX has met the demands of traditional customers well, however the steady advancement in manufacturing capabilities has lowered both the cost and size of satellites heading to orbit today. This reduction in cost has, in turn, given rise to numerous new applications that were not previously commercially viable. According to a 2018 report from Allied Market Research, the small satellite - smallsat - market is expected to grow at a CAGR of 20.1% to an overall size of $15.7 billion by 2026. Anticipating demand, industries utilizing smallsat constellations has exploded in recent years, ranging from Earth imaging to internet communications to university research. For example, one of the largest constellations in orbit today belongs to Planet Labs, an American Earth imaging company, with 150 active satellites in orbit. Their satellites weigh between 4 kg and 150 kg; in comparison, Intelsat 35e, a geostationary communications satellite built by Boeing, weigh 6,761 kg. Other companies, like OneWeb, Amazon, and SpaceX, are planning on launching even larger constellations, consisting of thousands of smallsats each, to provide internet communications from space. The industry is trending toward smaller satellites and Rocket Lab has planned their rocket for the emerging market.

Electron - Rocket Lab’s Workhorse Vehicle

There are two key criteria for the smallsat launch customers - cost and flexibility. They are much more price sensitive than big aerospace behemoths as their satellites are much cheaper, making the launch cost a much bigger portion of their total cost as a result. They are also turning towards small, dedicate launchers as they have traditionally launched their small satellites as secondary payloads on bigger rockets, which meant the primary customer dictated both the orbit and the launch schedule over the smaller satellite operators. Small satellites often had to wait years for their primary payload to get launched, and even then it may not be in a preferable orbit. A dedicated launch vehicle will offer the flexibility that smallsats traditionally lacked, but it must do so at an affordable price. Thus, smallsat launch vehicles must meet both of the above criteria to be competitive.

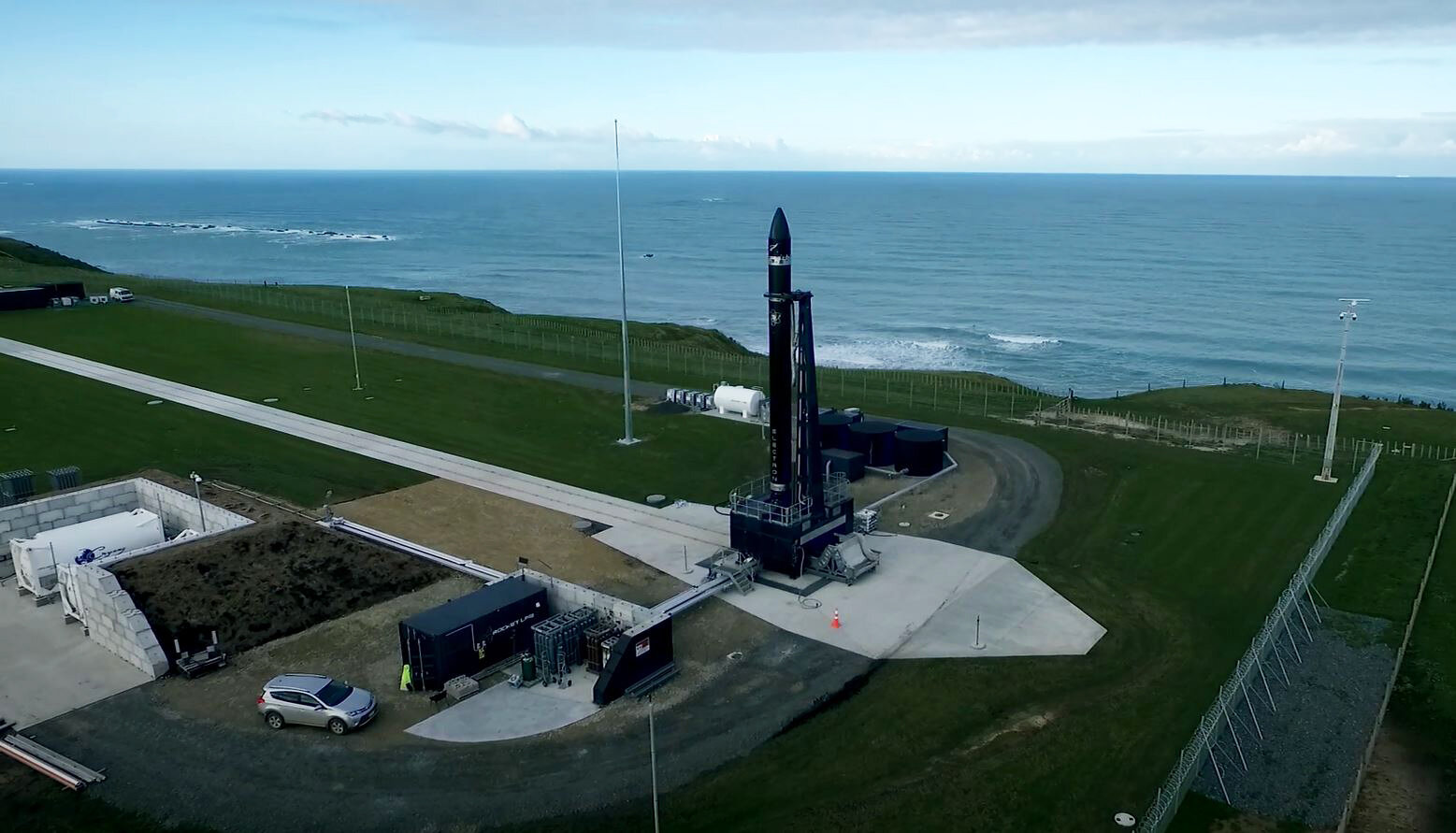

Enter the Electron, Rocket Lab’s first orbital class rocket and its workhorse vehicle. It is a two-stage, liquid-fueled rocket with a payload capacity of up to 225 kilograms into LEO at a list price of $6 million per launch. Standing at around 17 meters (56 feet) tall with a diameter of 1.2 meters (~4 feet), it is not a particularly large vehicle, but its jet-black exterior allows it to easily stand out. There are several aspects of the rocket that both lower cost and improve reliability:

Rutherford engine - this is the engine that powers both the first and second stage of the Electron, burning kerosene-liquid oxygen propellant. Rocket Lab adopts a 9-engine configuration on the first stage, providing redundancy in case of any one engine failure and allows economy of scale to lower the overall per-unit production cost, as opposed to a lower engine count configuration. The second stage uses a single vacuum-optimized Rutherford engine. The truly unique feature of this engine is that it uses electrically powered pumps to deliver fuel to the combustion chamber. Traditionally, engines are powered by turbopumps, which burn a bit of fuel to drive the pumps that deliver the rest of the fuel to the combustion chamber. Rocket Lab’s battery approach reduces complexity and improves fuel efficiency as 100% of the fuel is used to propel the rocket.

Robotized Manufacturing & 3D Printing - Rocket Lab utilizes several innovative manufacturing techniques to speed up the manufacturing process. For example, the Rutherford engine is fabricated via 3D printing with electron beam melting, which allows complex structures (such as a combustion chamber) to be made with high-strength, hard to manipulate material. The company also enlists the help of a robotic manufacturing system named “Rosie” that automates the processing of carbon-fiber material for the rocket; the custom-made machine can produce parts of the entire Electron rocket in 12 hours, compared to the 400 hours that was previously needed.

Reusability - The key to cost reduction is reusability, and Rocket Lab is currently planning on recovering its first stage via a parafoil and helicopter - essentially having the first stage come back down to Earth via parachute and using a helicopter to grapple it out of the air. The company completed a trial run of this recovery architecture in March 2020, demonstrating its viability. It originally planned to proceed with a full recovery attempt by the end of 2020, though such plans have been disrupted by the Covid-19 pandemic.

Rocket Lab’s March 2020 Recovery Test

Source: Rocket Lab

The goal of all of these manufacturing decisions are to increase the rate of output, which will not just support the projected dozens of launches per year, but to utilize economy of scale to lower the cost of manufacturing overall, allowing the cost of launch to further decrease.

While the Electron is a truly unique rocket and that it is the flagship product of Rocket Lab, the company has ambitions to tap into the growing smallsat market directly, by providing a standardized satellite bus named the Photon.

Photon - The Secret to Rocket Lab’s Future Success

Photon is a satellite bus based off of Rocket Lab’s optional third stage, which is powered by a single Curie engine using a proprietary monopropellant. The product provides the power, propulsion and avionics required for an operational satellite, allowing customers to simply attach their desired instruments or payload to the bus rather than building one themselves. This has the potential to massively reduce costs for customers as the standardized Photon bus will have the advantage of economy of scale. In an interview with the YouTuber Everyday Astronaut, CEO Peter Beck outlined the company’s plan to offer an end-to-end satellite production and delivery service, offering both the satellite manufacturing as well as orbital delivery service.

Even though the Electron rocket is the headliner for Rocket Lab at the moment, Photon will play an integral role in Rocket Lab’s future growth. It allows the company to capture a part of the satellite manufacturing value chain and funnel customers to its own launch service at the same time, as the Photon is only offered on Electron launches. Given the high entry barrier of building satellites, the Photon kills two birds with one stone, allowing customers to get to orbit faster and cheaper while further cementing Rocket Lab’s position as the leading smallsat launch provider. This mutually reinforcing effect will help the company fend off new entrants to the market, with companies such as Astra and Virgin Orbit planning their first launches in 2020.

Conclusion

While the company is not as high profile as Elon Musk’s SpaceX and Jeff Bezos’ Blue Origin, Rocket Lab is the frontrunner in one of the most competitive markets in commercial space: smallsat launch market. Given the relatively lower barrier to entry, dozens of companies are competing to launch the thousands of smallsats projected to launch in the upcoming years, though none have made as much progress as Rocket Lab. Its focus on economy of scale and innovative manufacturing techniques to lower cost has helped drive up its launch manifest, with the company planning to launch up to 12 missions in 2020. Future advancements in its reusability efforts, Photon satellite bus, as well as the opening of its second spaceport, located in Virginia, will continue to lower costs and offer flexibility to smallsat operators who traditionally had little in the way of tailored service. Even with the entry of well-funded (and no less impressive) competitors, Rocket Lab is well positioned to dominate the smallsat launch market for years to come. Like the name of its third mission, “It’s Business Time.”

April 2020